WE HAVE ESTABLISHED THE “CLUB” AS A TRUSTWORTHY BRIDGE FOR B2B, B2C, AND, C2B PAYMENTS, AND, SOURCE OF FUTURISTIC FINANCING PLATFORM THAT PROVIDES INNOVATIVE FINANCIAL SERVICES FOR INDIVIDUAL INVESTORS, AND, COMPANIES, THE LEADER IN NEWS & INFORMATION ON CRYPTOCURRENCY, DIGITAL ASSETS, AND, THE FUTURE OF MONEY.

WHAT THE “CLUB” PROVIDE IS, BUT, NOT LIMITED, TO:

IN HOUSE SEED FUNDING – SECURE FUNDING

Run a pre-seed round to attract investments from multiple funds. Having something in development boosts your chances.

CLIMB HIGHER

After substantial progress, you can either opt for a seed round (or, go public listed on a secondary Offshore Exchange & DEX), depending on your project’s status.

CLIMB HIGHER

In place since 2001, and, applies to all financing operations, independent of geography and sector. This facility applies to all non-crisis financing opportunities.

CLIMB HIGHER

Designed to address national and local crisis, as well as economic crisis impacting industries due to disruptions in their production processes, such as supply chain breaks, primarily due to a crisis, and companies broadly affected by crisis-related economic adversities (sometimes, collaterals maybe needed at the discretion of lending party normally, ISIN instruments).

We will finance, in-house, any projects with expected ROI (Return on Investments), equal or greater than 50% monthly, or, more (with no limit of funds amount). All projects will be examined without prejudice (including with humanitarian/charitable scope one).

We do Crowdfunding finance, in-house, all projects with ROI (Return on Investments), equal or greater of 50% monthly, or, more (with no limit of funds amount). We, also, do that with TOKENIZATION of project financing.

Project finance is the funding of long-term infrastructure, industrial projects, and, public services using a non-recourse or limited recourse financial structure. The debt and equity used to finance the project are paid back from the cash flow generated by the project.

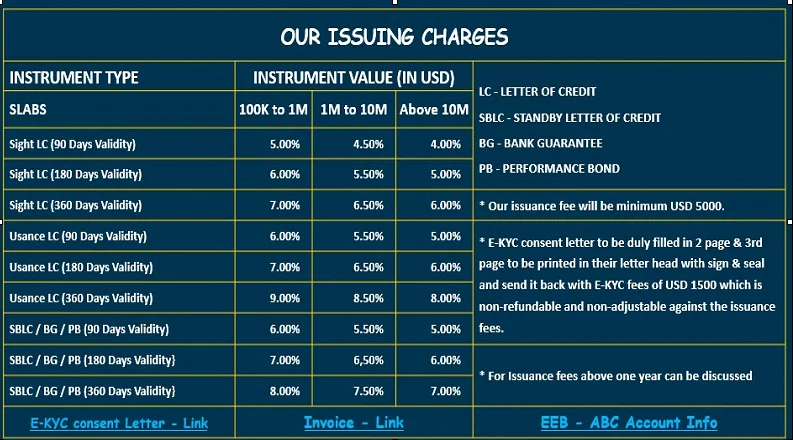

ALSO, THE “CLUB” CAN PROVIDES, ON SPECIAL REQUEST FOR ITS MEMBERS ONLY, THE FOLLOWING FINANCIAL SERVICES, WITH MESSAGE TYPE MT103/MT700/MT760/MT999 SWIFT, MT799/MT760 (SBLC), CONFORM TO ICC 758 (PARIS, FRANCE – LATEST REVISION).

Upon receiving the signed DOA, Lessee will instruct his bank to issue “RWA”, and, accepted approved verbiage of MT799/MT760, via Secured E-mail to Issuing Bank, and, provide copy to Provider’s Company E-mail.

Upon receiving the “RWA” Secured E-mail copy from Lessee Bank, in 5-7 banking days, with escrow account, performed by a class “A” international licensed bank with “BIC/SWIFT”, issued through top AAA rated international banks, with a “NON-CIRCUMVENTION AGREEMENT”, signed and on our file, prior to do any transactions (adding 5% for the Club administration commission fees – payable in fiat/crypto, and/or, in certain circumstances, in arrears):

PLEASE NOTE:

often, the MT700 is available in the Banks “LC System”, and, the MT760 is available in the Banks “Guarantee System.” Since a Standby Letter of Credit is in reality a guarantee; fees must be calculated as any other guarantee – i.e. in the Banks Guarantee System – which would not allow the use of a MT700.

Also, the Club has intelligence access to Lombard Loan & Back-to-Back Financing, Self-Liquidating-Loans, and, special 40 yrs mortgages in low interest currencies (mostly Yen). Terms may vary, depending on your residential status (and, collateral maybe needed at the discretion of lending party, normally, ISIN instruments).

BONDS

A form of Guarantee given by the Bank, to facilitate clients carrying out business transactions without delay.

PERFORMANCE/BID BONDS

A buyer may seek an assurance that a supplier can perform a specific supply contract and may seek a Bond confirmation from the Bank. These endorsements on the part of the Bank serve as a method of confirming the sound financial standing of a company, as well as its ability to honor its obligations.

The Performance Bond is issued for a percentage of the contract (usually 10%). With the Bid Bond, the Bank endorses a company bidding for a specific project.

A Bid Bond is also issued for a percentage of the project (usually 5% + our commissions).

GUARANTEES

This instrument is less rigorous than a Letter of Credit; this instrument is negotiated between an importer and a Bank. The Letter of Guarantee confirms to the supplier that payment will be made once the pre-agreed supply terms have been satisfied. This eliminates credit and payment risks for the supplier.

A WIN-WIN E-COMMERCE PROGRAMME

GRAN CANARIA, TENERIFE & LANZAROTE

The main legal and tax issues to take into consideration regarding e-commerce, digital economy, and, privacy are discussed in this Chapter.

In Spain, as in neighboring countries, e-commerce-related activities are currently the object of specific regulation granted by the EU, to Spain – see “Domain Names Law 34/2002 on E-commerce & Information Society Services (ECISSA)”.

In transactions involving e-commerce, regard should be had to the legislation on distance sales, advertising, standard contract terms, data protection, intellectual & industrial property, electronic invoicing, finding local partners, mentoring, giving visibility, , and, information society services, among others, working alongside mentors, lawyers and ecosystem contacts to accelerate your growth, when doing e-commerce buinsess. Apart from these specific laws, it is also necessary to examine the general legislation on Civil & Commercial contracts and, when in case of e-commerce addressed to consumers (B2C), the specific regulation on consumer’s protection should also be considered. Additionally, matters such as cybersecurity or electronic identification (electronic signature), have an increasing importance.

From the tax perspective, e-commerce raises issues, which would require a consensus to be reached on measures to be adopted at regional and even global level. Fair progress has been made in reaching a consensus on the VAT treatment of “on-line e-commerce”. As regards the Tax on Certain Digital Services, although Spain has created this tax, we will have to wait for a coordinated, uniform interpretation of the various criteria determining the tax treatment of e-commerce at international level.

In relation to e-commerce, Law 4/2020 of October 15, 2020 on the Tax on Certain Digital Services (“TCDS”) came into force on January 16, 2021, such tax being levied on the provision of certain digital services involving users located in Spanish territory. As shall be explained in greater detail in the section on direct taxation, this is a measure adopted by Spain unilaterally, on a transitional basis, through provisional legislation which shall remain in force until a solution adopted internationally can be implemented.

On the other hand, in relation to VAT, Spain has assumed commitments at European Union (“EU”) level. On this regard, the Canary Islands are considered an “Outermost Region” of the European Union, so, they get better tax treatment.

Below is a list of the basic pieces of VAT legislation emanating from the EU: Council Directive 2006/112/EC of 28 November 2006 on the common system of value added tax. Council Directive 2008/8/EC of 12 February 2008 has amended Directive 2006/112/EC as regards the place of supply of services, introducing, in particular, rules applicable to telecommunications, broadcasting and electronically supplied services, with effect from January 1, 2015. On the other hand, Directive 2017/2455 of 5 December 2017 also introduced certain amendments in relation to on-line trading in goods and services. Part of these amendments came into force on January 1, 2019 (those affecting trade in services) and the pertinent changes have therefore already been made to internal legislation. Other measures, however, will not come into force until January 1, 2021 (those relating primarily to distance sales of goods) and

are pending transposition into Spanish legislation.

Finally, other measures came into force on July 1, 2021 (those relating primarily to distance sales of goods) and have been transposed into Spanish legislation by means

of Royal Decree-law 7/2021 of April 27, 2021.

Additionally, Council Directive 2019/1995 of 21 November 2019 introduced amendments which came into force on July 1, 2021, related to distance sales of goods

and certain domestic supplies of goods.

SOMETHING MORE TO READ:

SPECIFICALLY:

FOR MORE INFO AND ASSISTANCE, DROP US A LINE.

P.S. Minimum capitalization for an LTD local company (€3000 for a Sociedad Anonima), a statutory notary contract is needed to incorporate. Shareholders must be identify, or, Nominee/Freelancer Director can be used upon request, at an extra cost.

APPLY NOW

Borrow between £25k – £100k to invest in your business plans.

What we can offer:

A business loan over an agreed term up to a maximum of 7 years with monthly repayments of capital and interest. This term can be longer in appropriate circumstances.

Our Business Loans are available to businesses that are 24 months or older (but earlier stage businesses can be considered too).

Loan amounts range from £25,001 – £100,000 (possibly more in eligible cases) and are subject to satisfactory credit and affordability checks.

ELIGIBILITY

Am I Eligible?

We do our best to make it simple for you to access our funding so you can put your growth plans into action.

Have a sound business plan, a well thought-through proposition supported (in some cases) by profit and cashflow projections demonstrating the benefits the proposed loan will bring to the business.

Have had a successful and profitable business that has usually been trading for 24 months or over

be unable to access any or sufficient funding through a conventional bank loan not be currently subject to a bankruptcy order or an IVA (Individual Voluntary Arrangement) or a DRO (Debt Relief Order) be willing to declare any previous credit issues

TO BE ELIGIBLE, YOU MUST…

A) Reside in the UK.

B) your business must be based in these areas: Sussex, Surrey, Kent, Essex, Suffolk, Norfolk, Cambridgeshire, Hertfordshire, Hampshire, Isle of Wight, Berkshire, Buckinghamshire or Oxfordshire.

C) Have the right to live and work in the UK.

D) Be aged 18 years and over at time of application.

E) Have a business type and purpose for loan that is eligible under the terms of the scheme.

F) Pass a credit checks, and, show that you can afford to repay the loan.

The new iteration of the Recovery Loan Scheme (RLS), launched in August 2022, and, is designed to support access to finance for UK small businesses, as, they look to invest and grow.

The Recovery Loan Scheme aims to improve the terms on offer to borrowers. If we can offer a Funding Circle business loan on better terms, they will do so.

Businesses that took out a CLBILS, BBLS, or, RLS facility before 30 June 2022 are not prevented from accessing RLS, from August 2022, although, in some cases, it may reduce the amount a business can borrow.

Recovery Loan Scheme-backed facilities are provided at their discretion, and, they are required to undertake their standard credit and fraud checks for all applicants, through major credit agency (Experia, Equifax, Tran Union, etc.).

To be eligible to apply for the Recovery Loan Scheme with Funding Circle, you must:

1) Have a turnover of up to £45 million.

2) Be trading in the UK for a minimum of 2 years (even, with a non-resident subsidiary).

3) Be a limited liability company.

4) Use the loan for a business purpose such as working capital or investment.

5) Not be in difficulty or have any collective insolvency proceedings ongoing

We can help secure startup loans to accelerate your business growth

Start-up business financing with unparalleled flexibility

Everything You Need To Know:

What is a start-up loan?

Why choose us for your business start-up loan?

How can I apply for a start-up business loan?

What are the pros of start-up business loans?

Can I get a start-up loan with bad credit?

Do start-up loans require personal guarantees?

What is a start-up business loan?

A start-up loan is a type of finance designed to help new businesses that have been trading for less than 24 months. Start-up business loans enable budding entrepreneurs to pay for key requirements, such as funding the launch or early stages of their new company.

Startup business loans are usually unsecured, so there is no need to provide valuable business assets as security. With start-up finance, you can:

• Receive between £1,000 – £500,000

• Repay over a period of 1 – 3 years

• Benefit from competitive interest rates

Business owners can get a startup business loan from traditional lenders such as banks or alternative lenders, like online lenders and credit brokers. New businesses can find it particularly challenging to secure funding from lenders because they are perceived as ‘higher risk’.

Your chances of being approved decrease with a limited trading history and lack of considerable capital or collateral. Luckily, there has been a rise in alternative finance providers, and nowadays, start-ups have more options than ever before. You can receive loans for starting a business from:

Online lenders, the Government, Banks, Investors, Online lenders & Credit Brokers

Online lenders and Credit Brokers provide financing options for businesses, making it easier for new businesses to get approved for quick finance. They provide start-ups with choice and flexibility, and some lenders even offer to fund businesses with bad credit.

Because applications can be completed entirely online, the whole process is sped up, and funds can be accessed in just 24 hours – as opposed to the weeks it can take to get approved by banks or the government.

As well as this, online lenders tend to have extremely transparent fees and loan terms. So, when you borrow as a business owner, you’ll know exactly how much you need to pay back and when you need to make repayments. Many lenders also offer more personalized services and will send you email and text reminders for deadlines to help you manage your finances.

HIGH APPROVAL RATES

ALL CREDIT SCORES WELCOME

QUICK PAYOUTS

TRADITIONAL LENDERS

For centuries, traditional lenders, like banks, have been the go-to source of finance for companies. However, in this day and age, it can be challenging for SMEs to secure funding through such conventional means, and even harder for recently launched businesses to do so.

This is predominantly because banks now tend to focus on larger corporate borrowing, imposing rigorous application processes and strict lending criteria with low approval rates.

Applications with banks are lengthy; after submitting the relevant documents, you’ll probably need to schedule a follow-up or book an appointment with your local branch to discuss the application in person. It can take weeks or even months to hear back, and even longer to receive the funds in your account.

So, whilst you can often borrow larger amounts from banks, fresh ventures tend to struggle because their business models are unproven, and they have a lack of sales history.

Strict lending criteria

Good credit score required

Payouts vary from weeks to months

The annual percentage rate on startup loans will vary depending on the lender and the type of finance product you’re applying for. Furthermore, factors such as monthly turnover, credit score and the age of the business can all affect the rate of interest. Therefore, it is difficult to pinpoint exactly how much the interest rate will be on a start-up business loan.

If you are unsure about the interest rate, always ask the lender that you are matched with how much the APR is.

We recognize the difficulties emerging businesses face when sourcing funding in their early stages. As a financial broker, we aim to provide a quick and affordable online lending service, matching startups to the best lender for their business and delivering all help and support as required. It offered:

• Unsecured funding options: Business loans and merchant cash advance products up to £500,000.

• Lightning-fast approval: Receive the funds you require in as little as 24 hours.

• Responsible lenders: A panel of lenders regulated and approved by the Financial Conduct Authority.

• Bad credit options: Solutions for new businesses with adverse personal or business credit history.

• No application or set up fees: Apply online on our www free of charge.

• Trusted account managers: Our team will do all they can to find the best lender for your business’ needs.

As a bare minimum to be eligible for a start-up business loan, your business is required to meet the following criteria:

1) Business must have been trading for between 6 – 24 months.

2) The business owner must be over the age of 18.

3) The business must be registered in the United Kingdom.

4) As a bare minimum to be eligible for a start-up business loan, your business is required to have been trading between 6-24 months. The business owner must be over 18-years-old and the business must be registered in the United Kingdom.

The Gov offers venture business loans to all businesses in their first twenty-four months of operating. Whilst a business credit check forms a necessary part of the application, we aim to help all businesses, even those with poor credit, and our lenders will consider various factors before deciding.

New business owners can receive between £1,000 and £500,000 in unsecured funding by simply applying online. Choose a repayment plan which suits your business’ needs best, over a period of 1 – 3 years. Find out how to get a startup business loan in the UK:

• Step 1: You will first be asked some basic details to verify your startup. Please expect to disclose the amount you want to borrow, your average monthly turnover, the name of your business and months trading.

• Step 2: Your application will then be directed further down the page, where you will be asked to fill in your contact details, including your full name, position in the company, email and phone number.

• Step 3: After you accept the terms and conditions, you can be able to click ‘get my quote’. From here, your application will be processed and reviewed by one of our account managers.

• Step 4: Once you have been matched with a lender, the terms of your agreement will be discussed. At this point you are welcome to ask the lender anything you have concerns about, including repayment plans, to make sure there are no nasty surprises along the way.

• Step 5: Carefully read through the terms of the agreement, sign all relevant documentation and return it to the lender. You will then be able to access the money from your account in just 24 hours.

What can I use a start-up business loan for ?

Start-up loans come in the form of personal or business loans and can be used to help businesses that have been trading for less than 24 months. The loan can be used for business-related matters only, such as purchasing equipment, setup costs, recruitment, training and many other uses.

A new business loan is a cash injection that can propel business growth and success. Startups encounter considerable costs in their early stages. Areas where this funding could be useful include:

Set up costs: It’s expensive getting business ambitions set up, from administrative costs to buying enough stock to serve customer demands, external finance can aid initial outgoings.

Cash flow issues: The first few months of running a business can be the most challenging. New businesses often require a cash flow injection in order to keep things running smoothly; without external funding, this can be tricky to succeed alone.

New premises: This is often one of the highest costs when establishing a startup. Leasing or purchasing an appropriate premise is crucial to financial success but can often be one of the hardest things to obtain when setting up a new business.

Advertising & promotion: All businesses need to invest in PR and promotion. It is crucial for smaller businesses that need to establish a growing customer base. This money can help create and promote your brand, and fund the launch of marketing campaigns to spread the word.

Business website: When setting up a business, a company website is crucial to attracting customers and promoting your brand. Without a web developer, it can be costly to create a well-designed, high-tech site, which is another way business finance can come in handy. These days, over 50% of searches come from mobile devices, so make sure your website is optimized for mobile use!

Staff recruitment: As your business grows, you’ll need to hire more employees. It can be a financial strain getting new people on your team, but if you put this off and invest too late, it can harm your business’ success significantly.

Receiving an influx of cash for your business can be exciting and overwhelming at the same time. It’s important to sensibly and effectively utilize your loan to prevent common business spending mistakes.

Where possible, put your business funds in a separate account from your normal business account, transferring the money across as and when you need it.

Maintain a good rapport with your lender always. Keeping an open and honest dialogue ensures a good relationship should you have issues with future repayment deadlines.

Set up automatic repayments to make sure you are never late or miss payment deadlines.

What are the pros of startup business loans?

Start-up loans provide endless advantages to companies in their early stages of operating. A huge number of companies in the UK would be forced to cease trading without the safety net of external funding. Therefore, if you’re confident in your business plan you could reap the following benefits:

• Retain ownership: Unlike funding from investors, a business loan enables you to keep 100% of your business’ shares and decisions.

• Build business credit: If done responsibly, borrowing money can help to build your business’ credit score. This will increase your reliability in the eyes of the lender, enabling you to be approved for more funding in the future.

• Unsecured funding: As a newly established business, it’s unlikely you’ll have a vast amount of assets ready to put up as collateral. As unsecured start-up business loans have no collateral attached, it keeps the equity within your business assets safe.

• Finance business growth: Give your business venture the cash boost it needs to succeed.

What are the types of start-up business loans?

This form of finance is imperative for new business owners. There is a whole range of options available, and it’s important to do your research before making any hasty decisions. These are the main types of start-up business financing:

Unsecured business loan

Merchant cash advance

Funding from Angel investors

Bank funding

Government funding

Crowdfunding

Business Credit Cards

These suit new businesses that are typically looking to borrow smaller amounts of money without providing collateral. Because they are ‘unsecured’, the lender will ask for business assets as collateral if the business fails to repay the loan. They usually have shorter repayment terms, and whilst unsecured start-up business loans are arguably less risky, they can come with slightly higher interest fees.

A merchant cash advance is different from a traditional loan because the money you pay back is calculated as a percentage of your earnings, which is ideal for keeping repayments in sync with cash flow.

This flexible funding option has no APR attached and is essentially an advance on the revenue your start up is predicted to make on future debit or credit card sales. We offer this innovative product to newly established businesses that are able to provide 4 months’ worth of card and business bank statements.

Access between £5,000 and £500,000

Keep 100% of the money generated through cash sales

No interest charged, one inclusive fee

If you’re looking for money, business credit cards may be a source of finance to consider. Often they are used as a short-term solution for borrowing money, rather than the long-term.

The other benefit of a business credit card is that it can be used by any business size, meaning it could be useful for start-ups that may only have a few personnel.

Often startups don’t have a great business credit score or history, but a business credit card can help build up a company’s credit rating if used correctly.

Support to start, fund and scale your business. Virgin Start Up is a not-for-profit company, founded by entrepreneurs, for entrepreneurs just like yourself.

A Start Up Loan is a personal loan for entrepreneurs looking to start or scale their business and offers the following possibilities:

•Borrow up to £25,000 per co-founder;

•Borrow over 1-5 years at a rate of 6% fixed p.a.;

•No set up fee or early repayment penalties.

Every loan comes with one-to-one support from a business advisor and a mentor, hand-picked for your start-up.

Contact through: Email, Twitter or Facebook

SWOOP!

Swoop has partnered with UK and European business grant providers, as well as Local Enterprise Partnerships (LEPs), to offer you access to these grants and schemes all in one place. This platform allows you to navigate through a range of support avenues and tailor a grant to your needs.

Call: 0203 514 3044

High-net-worth individuals, Angel investors look to invest their own money into potential business opportunities. As well as providing finance, they can also bring valuable ideas and advice to startups to help them get off the ground. Whilst Angel investors can be beneficial, there are some things to be aware of before choosing this type of financing:

Although you don’t have to pay your investor back the capital, you are handing over equity in your business and a portion of your future net earnings.

You can expect angel investors to take a hands-on approach. They will want to be an active part of decision-making regarding your startup.

It’s true that banks offer finance to businesses, but unfortunately, it’s incredibly difficult for new businesses to obtain this because they are the riskiest applicants banks encounter. These traditional lending facilities will often deny start up business loans due to a lack of experience, management and customer base.

Banks provide secured business loans that require you to offer up assets as collateral for the loan. By ‘securing’ the loan against assets, the lender has a way of reclaiming their money if your business defaults on payments.

Often traditional lenders will charge early repayment fees to recover the amount you would have paid them in interest.

A funding product that is growing in popularity, crowdfunding enables businesses to receive small amounts of money from a number of people to raise the needed capital for their business. The investment is either for debt, equity or reward.

Also known as peer-to-peer lending, debt-based crowdfunding functions similarly to bank funding, except that you are lending from multiple different people. When using a peer-to-peer lending site, businesses get assessed for credit-worthiness before being improved.

Operating like marketplaces, bringing together lenders and those needing loans, it is the investors who can decide an appropriate interest rate. Whilst investors gain no physical reward nor any share in the business, instead they receive interest from the borrowing business on the money invested. Debt-based crowdfunding can be far riskier for startups than normal business loans:

Interest rates are usually far higher with peer-to-peer lending.

A lot of debt-based platforms change expensive fees to use their sites.

If you have a poor credit score, you might find yourself unable to obtain funding for your startup, and an unsuccessful application can further harm your credit report.

Equity crowdfunding

This is the process where people invest in a new venture in exchange for shares in the business. As a shareholder, the investor then has partial ownership of the company and can then profit if the company does well.

It was previously restricted to wealthy people and business angels, but equity crowdfunding platforms have opened this up so that more people can now invest. Equity crowdfunding can be a smart way of financing your business, but it does come with its disadvantages:

Almost all equity crowdfunding platforms charge monthly fees or success fees when matched with investors and granted money.

It can take a long time to acquire enough funding from investors.

You are forced to give up some ownership of your company.

This crowdfunding option involves individuals contributing small amounts of money to a business in return for some form of reward. As a business owner, you will pitch your business on a platform and gain donations in return for rewards such as handmade products, thank you cards etc.

Rewards crowdfunding works well for startups in creative fields that want to test the market with their products or services. However, it comes with its own pitfalls:

If you don’t manage to reach your goal amount through investments, you will have to forfeit any raised funds.

You are relying on individual donations, so the amount you can obtain is relatively small.

If you don’t have a patent in place, you risk exposing your business ideas to potential competitors.

Microfinance customers come from a diverse range of industry sectors and from all across Ireland, and, the rest of the world.

They provide unsecured business loans up to €25,000, to both Start-ups, and, established businesses, that, are having difficulty in getting access to funding.

They lend to businesses in Hospitality, Food & Drink, Manufacturing, Construction, Retail and Services, E-commerce, to name a few.

Microfinance lends to small businesses based in the Republic of Ireland with fewer than 10 employees, and, annual turnover must be less than €2m (micro-enterprises).

There must be at least 1 full-time position in the business, either, for you, or, for somebody else.

Under the InvestEU Fund, there are a number of restricted sectors, and/or, business activities that MFI cannot support. To see the full list of restricted sectors please click here: https://microfinanceireland.ie/exclusions/

Microfinance as a not-for-profit lender that is Gov funded, and, it is there to support viable businesses with the funding that they need to set-up, manage, or, grow their business.

Many of their customers come to them, either, directly, or, through one of their partners, the Local Enterprise Office, or, Local Development Company, or, after being turned down for credit by their Banks.

So, whether you are just starting out, need some help with managing cash-flow, or, are scaling up your business, check out their Loan Packages and see, how, Microfinance can help you today.

“Nominee” director & company secretary provided, in case, they are needed – FREE

* You can also, see exclusion sectors financed at the bottom.

Can you claim for tax relief for your start-up Irish company ?

How is the relief calculated ?

How do you apply for tax relief for your start-up Irish company ?

f you have started a new company, you may be able to apply for tax relief for start-up companies. This tax relief, also known as Section 486C Tax Relief, is a reduction of your Corporation Tax (CT), for the first five years you trade, only.

The relief can be applied to the profits from your new trade, and, on chargeable gains made on assets used in that trade.

You may be entitled to relief, if, your CT, due is €40,000, or, less in a tax year. If your CT due is between €40,000 and €60,000, you may be entitled to partial relief.

Tax relief for start-up companies also depends on the amount of employer’s Pay Related Social Insurance (PRSI), you pay. This must be a maximum of €5,000 per employee and €40,000 overall.

Since 2013, it may be possible for your company to carry forward any unused relief from:

⦁ The first five years of trading where the qualifying trade commenced on, or after, 1 January 2018

or

⦁ the first three years of trading where the qualifying trade commenced before 1 January 2018.

Certain restrictions may apply, so, ask CRO (COMPANIES REGISTRATION OFFICE).

A UCITS is a public limited company formed under EU Regulation (European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations 2011 & 2016) and the Companies Act 2014.

The sole object of a UCITS is the collective investment in transferable securities of capital raised from the public that operates on the principle of risk-spreading.

The competent Authority, which must approve all registrations of UCITS that wish to carry on activities within the State, is the Central Bank of Ireland.

A Societas Europaea, or, SE is a European public limited company formed under EU Regulation (Council Regulation 2157/2001) and Statutory Instrument 21 of 2007. SE’s can be formed by merger, as a holding company, or, subsidiary, or, by conversion from a plc.

Article 3 and 10 of the Regulation requires Member States to treat an SE, as, if it is a public limited company, formed in accordance with the Law of the Member State in which it has its registered office.

An SE can be formed in several different ways, each with different requirements:

• by merger,

• as a holding company,

• as a subsidiary,

• an SE can form a subsidiary SE.

• an SE can be formed by a PLC converting into an SE.

Upon registration, an SE has legal personality. The registered office and the head office must be in the same Member State. A Societas Europaea has share capital and no shareholder is liable for more than the amount subscribed. An SE is required to have a minimum amount of subscribed share capital of at least EUR 120,000.

An EEIG must have a minimum of two members, who may be companies or natural persons, from different Member States. The manager of a Grouping may be a natural person or a body corporate.

On registration, a Grouping shall be a body corporate, have perpetual succession and a common seal and have legal personality.

A company will not be incorporated unless it appears to the Registrar of Companies that the company, when registered, will carry on an activity in the Republic of Ireland. “Activity” means “any activity that a company may be lawfully formed to carry on and includes the holding, acquisition or disposal of property of whatsoever kind”.

Form A1 contains a declaration that one of the purposes for which the company is being formed is the carrying on by it of an activity in the State. The declaration contains the following particulars:

• the general nature of the activity and the appropriate NACE code classification (The NACE code is the common basis for statistical classifications of economic activities within the EU and can be accessed on www.cro.ie).

• the place(s) in the State where it is proposed to carry on the activity.

• the place, whether in the State or not, where the central administration of the company will normally be conducted.

In the event a company is being formed to conduct two or more activities within the State, the particulars to be furnished on Form A1 relate to the principal activity. Even though a LTD Company:

– private limited by shares company registered under Part 2 Companies Act 2014 – does not have stated objects in its constitution it is still required to provide the NACE code information on the form A1.

Only companies which are particular company types may have the following words in their name:

• Limited (ltd) – Teoranta (teo), Public Limited Company (plc) – Cuideachta Phoiblí Theoranta (cpt), Designated Activity Company (dac) – Cuideachta Ghníomhaíochta Ainmnithe (cga), Company Limited by Guarantee (clg) -Cuideachta faoi Theorainn Ráthaíochta (ctr), Unlimited company (uc) – Cuideachta Neamhtheoranta (cn).

• Only the name of a Societas Europaea can be preceded or followed by the abbreviation SE. Use of the term ‘SE’ at the beginning or end of the name designates that it is a European Company.

• Please note that there may be a requirement for some management companies to include Owners’ Management Company in the company name. S. 14(3) of the Multi-Unit Developments Act 2011 provides that “the words “Owners’ Management Company” shall be included in the name of every owners management company to which this section applies”. This section applies to owners management companies of multi-unit developments in respect of which no contract for the sale of a residential unit has been entered prior to the enactment of this act or of a mixed use multi-unit development subject to section 2. Section 14 was commenced on 24th January 2011.

The Micro Business Grant Scheme has been designed for new start-ups or businesses trading for less than 18 months, with a turnover between £15,000 and £100,000. The scheme is also suitable for individuals looking to take their first steps into self-employment.

Funding of up to £6,000 payable as a grant, living allowance or combination of both:

Enhanced rate of £15,000 for exporting businesses and child care providers

Further assistance of up to £10,000 to support job creation

Approximate 16-hour flexible training course with morning, weekend or twilight schedules to suit you

18-month business mentoring

Training – The scheme includes an extensive business training course comprising approximately 16 hours with morning, weekend or twilight schedules to suit you. All training courses are split into 2 parts with both group and one-to-one tutorials, delivered by the University College Isle of Man. Training helps applicants consider their business idea, determine the eligibility and viability of the business and develop their business plan.

Financial Assistance – The scheme offers financial assistance of up to £6,000 (an enhanced rate of up to £15,000 for exporting businesses, child care providers and nurseries is also available) which can be in the form of a financial grant or a living allowance of up to £100 per week for a maximum of 60 weeks. Alternatively, applicants can opt for a combination of both, up to £6,000. Further assistance up to £10,000 is also available to support job creation.

Please note: Financial assistance of either a grant or living allowance is discretionary. All applications are treated on a case-by-case basis.

Business Mentoring – The business mentoring service goes hand in hand with the financial assistance. Applicants will be partnered with a business adviser, who will act as a business mentor throughout the initial business start-up phase; this is in the form of interim meetings over a period of 12 to 24 months, which can be tailored to the candidate’s needs and progress. In a recent satisfaction survey completed by attendees, business mentoring was seen as the most beneficial aspect of the scheme. Meet our Micro Business Advisers here.

The applicant/business must:

Be resident on the Isle of Man for income tax purposes

Be an Isle of Man worker or hold a valid work permit in respect of your intended business activity

Be over 16 years old

Be in control of your business

Be trading for less than 18 months, or not yet started

Have a turnover between £15,000 – £100,000.

Important note:

Provision of financial assistance is discretionary and the decision to provide assistance in any particular case will be based on the merits of the case including the turnover, profitability, viability and scalability of the business, the exchequer benefits received and the personal survivor plan of the business owner.

There is no guarantee that the full £6,000 (or £15,000 for exporting businesses and childcare providers) will be granted to the applicant.

Non-resident requirements.

Jersey is a self-governing dependency of the British Crown. It is not part of the UK and has independent control over its internal government, legislation and taxation. The Companies (Jersey) Law 1991 regulates the formation and administration of private companies in Jersey. It provides for several company structures all of which have different benefits and potential uses from commercial trading to joint ventures or investment holding vehicles.

If you are not a resident in Jersey, an important factor in deciding where to locate your company and which type of structure to use, will be the tax and regulatory implications of setting up on the island. As a result, it is essential that you get professional legal and tax advice in order to make a well-informed decision about the most appropriate structure for your individual circumstances.

Jersey has a range of legal practices with extensive experience of structuring non-resident companies and this is not an area where we provide specialist advice.

You can find out about these service providers through the Law Society of Jersey or on our Local Service Providers page and we highly recommend that you speak to a specialist in corporate law before undertaking the process of incorporation.

To get an overview of the actual paperwork involved in the process of incorporation go to our page on Setting up a Limited Company in Jersey. Should you wish to establish a physical presence in and operate from Jersey you will require a business license to do so, we recommend you speak to our colleagues at Locate Jersey on 01534 440604, locatejersey@gov.je or, www.locatejersey.com

We provide non-recourse, non-purpose capital at competitive terms in exchange for equity collateral. The equity becomes part of our portfolio for the financing term, but, the borrower retains all beneficial ownership, and, upside from the asset upon completion of the financing term.

Ethereum is an ideal platform for potential funders can come from anywhere – Ethereum and its Tokens are open to anybody, anywhere in the world.

It’s transparent, so, fundraisers can prove how much money has been raised. You can even trace how funds are being spent later down the line.

Fundraisers can set up automatic refunds, if, for example, there is a specific deadline, and, minimum amount that isn’t met.

Flash Loans are a disruptive functionality of Aave V1, which allow the creation of a variety of tools to refinance, collateral swap, arbitrage and liquidate.

Flash Loans have become a powerful mechanism of DeFi. In the initial V1 Flash Loan, a significant limitation is that it cannot be used within Aave. Aave V2 implements a solution to enable Flash Loans usage in combination with any of the other functionalities of the protocol, powering many new possibilities:

– Collateral trading. Change the exposure from one/multiple collaterals to another, without the need of closing the debt positions.

– Repay a loan with the collateral. Use collateral deposit in the Protocol to repay a debt position.

– Margin trading. Creation of margin positions that can be used for trading, later on.

– Debt Swap. Change the debt exposure from one asset to another.

– Margin deposits.

The Murabaha contract is a type of contract that operates in two phases, clearly distinct from each other:

a) A customer asks a bank to purchase a specific asset on his behalf, promising to repurchase it from the bank itself in the future. The promise is a non-binding condition from which the customer can withdraw (at the bank’s expense).

b) After having held the asset for a sufficient period of time (to be able to affirm the assumption of the risk of the purchase), the bank resells it to the customer at a price equal to its cost (the purchase price), increased by a profit margin (mark-up) predetermined.

A Murabaha contract may concern: (i) the sale-repurchase agreement of an asset held by the debtor (negative short sale), or, (ii) the purchase by the lender of a tangible asset from a third party on behalf of the debtor (back-to-back sale).

The most common case concerns short-term trade financing, often used to cover the time gap between invoicing and payment of a transaction. Indebtedness (which is determined by the difference between the purchase contract and the resale contract of an asset, existing or future) is limited by the purchase price of the underlying asset.

Being a sales contract, and, not a loan, Murabaha must honor all the validity requirements, such as:

– Existence of the good. The object of the contract must not be available in the future (to be produced or cultivated);

– Ownership of the goods by the seller at the time of the transaction;

– The sale must not be conditional;

– Value of the asset established with certainty at the time of the transaction.

There are a number of restricted sectors and/or Business Activities that MFI cannot support and these include:

Any activity which is illegal under the laws of Ireland or international law

The production of and trade in tobacco and distilled alcoholic beverages and related products.

The production of and trade in weapons and ammunition.

Casinos and equivalent gambling enterprises including internet gambling, online casinos, etc.

Sex trade and related infrastructure, services and media.

Activities which limit individual rights and freedoms or that violate human rights.

IT Sector Restrictions including R&D and applications supporting activities in restricted sectors.

Life Science Sector Restrictions including human cloning and Genetically Modified Organisms.

Activities involving live animals for experimental and scientific purposes.

Financial activities such as, inter alia, purchasing or trading in financial instruments.

Fossil fuel-based energy production and related activities including mining and exploration.

Energy-intensive and/or high CO2-emitting industries and sectors.

Investments in facilities for the disposal of waste in landfill.

Investments in mechanical biological treatment (MBT) plants.

Investments in incinerators for the treatment of waste.

Medical Cannabis and CBD oil related businesses.

Property Speculation and related activities including the funding of “Buy to Let” properties.

Applications to fund the purchase of road freight transport vehicles by persons or companies performing road freight transport for hire or reward.

If you are uncertain as to whether your business falls within the restrictions outlined above please contact them, by email, at info@microfinanceireland.ie, or, by phone at 01 2601007.